1.9 UIF (Unemployment-Insurance-Fund)

- Unemployment Insurance Act, 2001 (the UI Act)

- Unemployment Insurance Contributions Act, 2002 (the UIC Act)

- These Acts provide for the benefits, to which contributors are allowed, and the imposition and collection of the contributions to the UIF, respectively, and came into operation on 1 April 2002.

Unemployment Insurance Fund

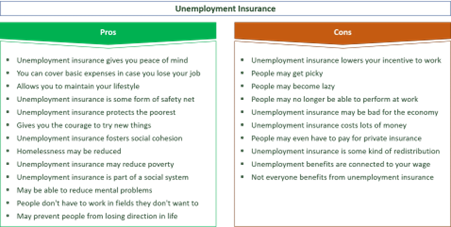

The Unemployment Insurance Fund (UIF) gives short-term relief to workers when they become unemployed or are unable to work because of maternity, adoption and parental leave, or illness.

Tasks

Watch the following video to gain more insight into the unemployment insurance fund:

- Is employed by the employer for less than 24 hours a month

- Is employed as an officer or employee in the national or provincial sphere of Government

- Is the President, Deputy President, a Minister, Deputy Minister, a member of the National Assembly, a permanent delegate to the National Council of Provinces, a Premier, a member of an Executive Council or a member of a provincial legislature

- Is a member of a municipal council, a traditional leader, a member of a provincial House of Traditional Leaders and a member of the Council of Traditional Leaders.

- Any employer, who is registered with SARS for Employees’ Tax, also needs to register to pay UIF contributions.

- The following employers must register at the UI Commissioner’s office for purposes of paying UIF contributions, an employer who:

-

Doesn’t need to register with SARS for Employees’ Tax purposes - Hasn’t voluntarily registered with SARS as an employer

- Isn’t liable for the payment of the skills development levy.

- Pays or is liable to pay remuneration to an employee must contribute on a monthly basis to the UI Fund.

- The amount of the contribution due by an employee, must be 1% of the remuneration paid by the employer to the employee.

- The employer must pay a total contribution of 2% (1% contributed by the employee and 1% contributed by the employer) within the prescribed period.

- A contribution shall not apply to so much of the remuneration paid or payable by an employer to an employee, as exceeds:

With effect from 1 October 2012 – R 14 872 per month (R 178 464 annually)

With effect from 1 June 2021 – R 17 712 per month (R 212 544 annually).

Please note: As from 1 June 2021, the maximum earnings ceiling is R17 712 per month or R212 544 annually. For employees who earn more than this amount, the contribution is calculated using the maximum earnings ceiling amount. Therefore the maximum contribution which can be deducted, for employees who earn more than R17 712 per month, is R177,12 per month.

Excess amounts shouldn’t be included as remuneration for the purposes of UIF contributions.The amounts deducted or withheld must be paid by the employer to SARS on a monthly basis, by completing the Monthly Employer (EMP201). The EMP201 is a payment declaration in which the employer declares the total payment together with the allocations for PAYE, SDL, UIF and/or Employment Tax Incentive (ETI), if applicable.

A unique Payment Reference Number (PRN) will be pre-populated on the EMP201, and will be used to link the actual payment with the relevant EMP201 payment declaration.

It must be paid within seven days after the end of the month during which the amount was deducted. If the last day for payment falls on a public holiday or weekend, the payment must be made on the last business day before the public holiday or weekend.